The most common mistake that anyone can make is thinking that a small business will only need a small business loan when launching the business itself or just during the business’ initial stages. A small business loan can actually give several benefits to a business that can be given at any point of the life of a business. Furthermore, there are several things that getting a loan can tell a business owner about the business like where it currently stands, where it can possibly go in the years to come, and how the business can get there.

No matter the industry or just how long a business has been or how long you have been a business owner, the ability to have access over a small business loan can be something invaluable to you and your business(es).

To solidify your choice of getting that small business loan for your business, we give you its top 8 benefits. But before that, here are a few things that we all must understand.

SMALL BUSINESS LOANS

Simply put, small business loans are agreements between a small business and a financial institution wherein the financial institution agrees to give the small business cash, and the small business agrees to pay off the cash in agreed upon installments. There are several terms and conditions that come with it.

A small business loan is not limited in where it can be applied on, and most times, this is the main reason why small business loans are what is preferred over regular business loans. They can be used for Payroll, equipment purchases, equipment upgrades, inventory, marketing and advertising expenses, and a lot more.

SMALL BUSINESS LOAN TYPES

There is more than one type of small business loans for small businesses to choose from. One type of small business loan differs from the others and some give big advantages depending on what the small business is in need of. Here are the most popular small business loan types used by small businesses:

Unsecured Business Loans: these are loans that do not need security when applying for it. Tends to have higher interest rates than most.

Short term business loans: these are loans that are usually repaid within 12 months upon receiving it.

Bad Credit Business Loans: these are loans that are for those businesses that have bad credit scores. This is essentially a last chance loan and their credit scores may actually get better with this kind of loan.

Invoice Discounting: this is a type of business loan where a small business takes all their unpaid invoices, exchanges them to a financial institution that gives about 90% of the price of the invoice. The business then will no longer need to chase their unpaid invoices as the lender will take care of it.

Equipment Loans: this type of small business loan is solely for the use of buying equipment. At times the equipment bought will serve as collateral but it would all depend on the terms and conditions agreed upon.

WHY A SMALL BUSINESS LOAN?

This may be one of the questions that pop into one’s head. Because after all, a small business loan is incomparable to a regular business loan in terms of the amount of money and time that the loan can be for? But here are several reasons as to why choose a small business loan.

A Lot More Options – There are a range of options when it comes to small business loans. This is because small business loans vary in the way that they can be used, thus a small business can actually have a lot of choices when it comes to choosing a small business loan.

Lower Interest Rates- While this may not be true of all kinds of loans, in reality, there are a lot more lower interest rates when it comes to small business loans.

Flexible Payment Terms – Compared to regular business loans, small business loans have a lot more flexible payment schedules and terms.

Fast approvals and fast disbursement of loan funds – Many financial institutions that offer small business loans can process an application transaction within 24 hours from application date. As a business owner, you must ensure that every requirement is ready, even the basic information such as: the purpose of the loan, the type of business you have, if there is a security for the loan, bank account details, and sometimes even a plan on how to repay the debt. This ensures that a business owner will have a speedy approval, success and disbursement of funds.

TOP 8 BENEFITS OF A SMALL BUSINESS LOAN

1. WILL HELP LAUNCH THE BUSINESS

The most popular benefit is of course that the business loan will help launch the business from business plan pages into a reality. In some cases, a small business may even be approved for such an amount that it is enough to pay for all of the initial starting cost that will help get the business running.

It is best for business owners not to over borrow when applying for a startup loan lest their business become a never ending debt cycle.

2. WILL HELP EXPAND THE BUSINESS

Another popular benefit of a business loan is that it allows the business to grow the operations and be able to expand. Using a small business loan, business owners can expand their business by buying additional assets, moving to a new and bigger location, or even opening a new branch in another city. These are all expansions that a business finance can help with.

3. WILL HELP BUILD CREDIT SCORE

Personal and Business credit scores will improve with every small business loan that will be completed and paid on time. And with good business scores, a business owner and the business itself will and can get approved for a variety of loans and even other financing options in the future. Especially if you are operating a new or a startup business, a small business loan will allow the owner to build business credit a lot faster, that is, if every payment is made on time.

There will come a time in a business life that the loan needed to apply for is not a small business loan; a good credit score in the long run will come in handy. Think of it as another way you are investing in the business. When that time comes, you will be able to look back at your credit history and be glad you took the time and effort to build your business’ credit score.

4. WILL HELP IN ASSET PURCHASING: EQUIPMENT ASSETS

Assets are an important part of the business as it will not only help with everyday operations, assets will also improve the overall business net worth. Assets like equipment are also often fairly expensive. A small business loan can help the purchase of new equipment that may be much needed by the business. This way, the business will no longer need to worry about where to get funds for the purchase of the equipment from its existing budget, and can use that budget into other expense allocations that are needed by the business.

This benefit is also something that will usually pop up when looking to buy equipment for the use of a business. This is because the merchant of the equipment may actually offer their own financing options for the equipment. If a business owner decides to take up the offer, this is already considered getting a small business loan. And as explained earlier, this will help in maintaining and ensuring that there is no harm in the business’ cash flow.

5. WILL HELP IN ASSET PURCHASING: INVENTORY ASSETS

Businesses that are seasonal purchase inventory by the bulk. With the help of a small business loan, businesses can invest in upcoming inventory assets for the next season in advance while the current season is ongoing. This not only saves money, but can also save time and effort, ensuring that there are already stocks for the upcoming season for the business and will not be in competition with other businesses as they also rush to get stocks for the impending season.

Other businesses that fit into this category can also take advantage of what are the most profitable, popular, and in demand stocks in the market. Business owners can use a small business loan to buy stocks that are in demand and make use of the current trend to make a quick profit because as business owners know, current trends come and go and a business must make sure to jump on these on time before they actually aren’t in demand as before.

6. WILL HELP DEVELOP A BUSINESS RELATIONSHIP WITH THE FINANCIAL INSTITUTION

When a small business takes out a business loan, this already entails a business relationship with the financial institution that the business is applying the loan with. Business relationships are all important when it comes to being a business owner as there will come a time where you need your business relations again and again. Nurture and care for this business relationship by paying on time.

A business owner can be surprised as business relationships can help in the long run, not only in the financial aspect but in other aspects of the business as well. For example, in terms of marketing, some financial institutions allow pamphlets from their partner businesses in their own place of business.

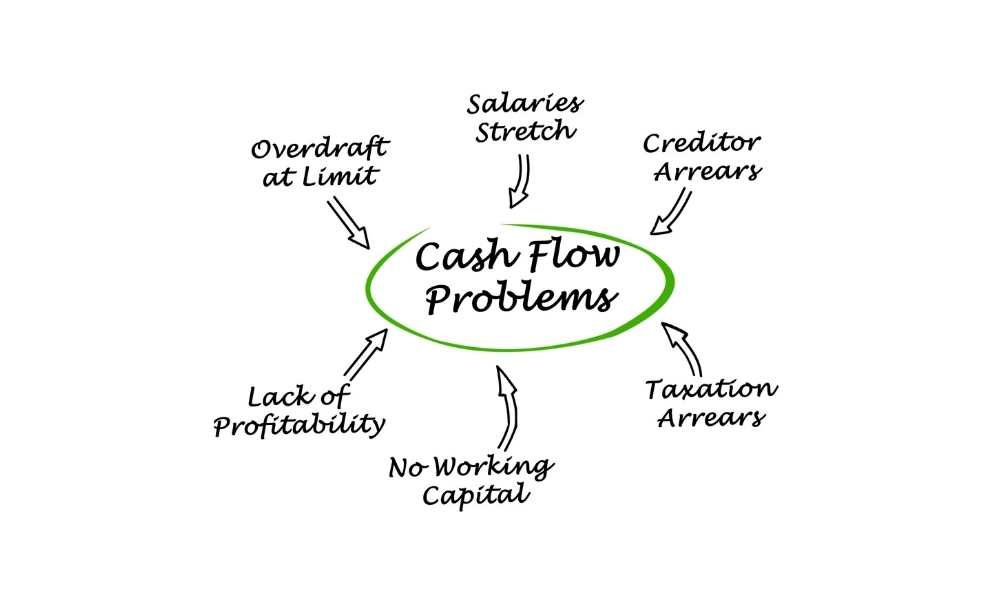

7. WILL HELP SOLVE CASH FLOW ISSUES

Most businesses can or will face cash flow issues one way or another. A small business loan can help a business that is faced with this problem. Particularly if the cash flow is inconsistent or sporadic, a business owner will find that a loan will come in handy. It is always better to have positive cash flow expenses rather than having negative cash flow as it will help better arm the business against incoming challenges in the finance sector in the future.

Managing the cash flow is actually one of the most common reasons for getting a small business loan. Oftentimes it is found that even though there is no lack of sales, there is a lack of working capital that is needed for the business to continue its daily operations.

8. WILL HELP COVER EMERGENCY EXPENSES

Every business will face an emergency that has been proven when the COVID-19 pandemic hit the whole world. Applying for a small business loan will help during tough times that need emergency funds in order for the business to breathe.

These are not the only emergencies that we mean, if for example small emergencies pop up that includes your business itself like utility repairs, electric problems, or even wifi problems, a small business loan can still help.

There are a lot of benefits that getting a small business loan gives to businesses, and if a business owner would like to reap these benefits, they should take the time to actually consider how and where to use it.

Remember that you should always take note of the business holy book: its business plan. Take time to indulge in it again to check what kind of loan the business needs as it will be easier to determine and pinpoint what the business needs in terms of finance. A short-term loan for example, is better if the business needs a specific amount lent to them and will be able to pay it back in less than a year.

Meanwhile, a long-term loan is the most viable option for small business owners that need long-term financing needs and if the business can handle paying for these loans over a longer period of time.

Moving forward, a small business loan should not be taken lightly. A business owner must be able to read and agree to the fine print that it entails and should already have a plan on how to pay back all of it. Support your business with a loan and help your business grow.

NEED FUNDING FOR YOUR BUSINESS? GET A FREE QUOTE TODAY AND GET FUNDED!

CLICK HERE TO GET A FREE QUOTE

Share this article