To understand bad credit business loans with their advantages and disadvantages, solutions lie in what these loans are, how they work, and what they offer to businesses with poor credit scores. This section explains the sub-sections briefly – what are bad credit business loans, how do bad credit business loans work, and the advantages and disadvantages of bad credit business loans.

What are Bad Credit Business Loans?

Bad Credit Business Loans are for businesses with a bad credit history, and a high chance of default. Interest rates and repayment terms are often harsher. They’re essential for companies unable to get conventional loans due to bad credit scores.

Secured and unsecured bad credit business loans are available. Secured ones require collateral, such as property or equipment. Unsecured loans are riskier for lenders, but no collateral is needed.

Bad Credit Business Loans have given many businesses the funds they need to keep going. But they should only be used when there are no other options. Be careful of predatory lenders; only borrow from reputable, accredited financial institutions.

Sarah’s Soap Company was turned away by banks, but they got a bad credit business loan. It allowed them to buy new equipment, expand product lines, and hire employees. Now, the company is doing very well, even with a poor credit score.

Bad Credit Business Loans are like a cool kid who helps the misfits. Even bad credit businesses deserve a second chance.

How do Bad Credit Business Loans Work?

Bad credit business loans provide a financing option for businesses with poor credit histories. These come with high interest rates, strict repayment terms, and may require collateral. Lenders assess the business’s financial health, track record and future revenue projections to determine loan amount and costs.

The evaluation process includes examining the business’s operations, profitability, expenses and assets. Some lenders check owners’ personal credit scores too. Application requirements vary, with some prioritizing cash flow over credit score, and some not considering personal credit at all.

Bad credit business loans can give businesses denied by standard financing a second chance. But, loan terms can be costly and cause more financial trouble if not managed properly.

Bella needed financing for her boutique but was rejected by many lenders due to bad credit. She didn’t give up, though; she looked into alternative financing options like bad credit business loans. A lender agreed to fund her based on her projected revenue and other factors. This helped Bella’s sales skyrocket. Bad credit business loans are like playing Russian roulette – but the gun is always fully loaded.

Advantages and Disadvantages of Bad Credit Business Loans

Bad credit business loans could be helpful to some, but they come with their own advantages and disadvantages. Here’s what you should know before getting one.

Advantages:

- Opportunity to improve credit history

- Access funds even with bad credit

- Quick application process

- Higher approval rates than traditional banks

- Flexibility in repayment terms

- Could help keep business going in tough times

Disadvantages:

- High-interest rates and fees

- Limited borrowing amounts

- Risk of predatory lenders and scams

- Could worsen credit score if payments are missed

- Personal collateral may be required

- Could create ongoing debt if not managed responsibly

It’s key to consider all the pros and cons when getting a bad credit business loan. But, one unique factor to think about is the potential for improving your credit history through timely payments.

To make the most of this opportunity, evaluate different lender options and create a payment plan that you can maintain. With proper management, bad credit business loans can provide much-needed funding while helping you rebuild your financial reputation.

Don’t let past mistakes hold you back from achieving your business goals. Consider exploring the option of getting a bad credit business loan. But, ensure that you do so by working with trusted, experienced lenders. You don’t want to miss out on opportunities because of bad credit.

If your credit score is in the gutter, don’t fret – there are still loans to keep your business afloat. Just be prepared for interest rates higher than the world’s tallest building.

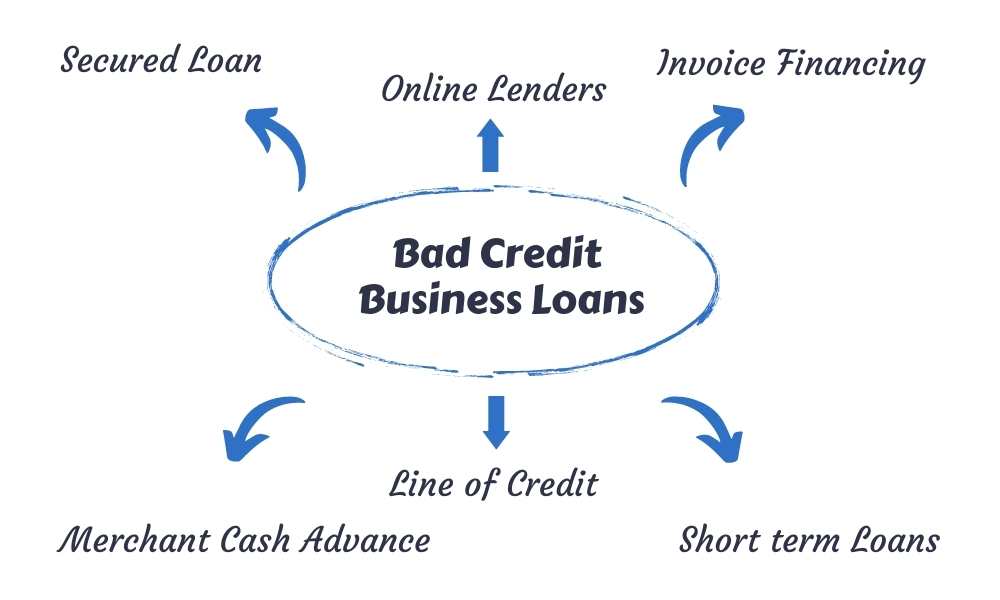

Types of Bad Credit Business Loans

To explore types of bad credit business loans with secured loans, unsecured loans, line of credit, merchant cash advances, and invoice financing as solutions. Gain insights into the sub-sections and understand their distinct features to make an informed decision on the right loan that caters to your business needs.

Secured Loans

Business owners with bad credit may find Secured Business Loans a viable option. These types of loans require collateral, such as property or inventory, for approval. Asset-Based Loans are great for those with high amounts of inventory or equipment. Real Estate Loans are good for acquiring new property and expanding operations.

Defaulting on a Secured Loan can lead to the loss of collateral. Therefore, proper planning and management is key. Businesses should aim to improve their credit scores to get better terms for future loans. Research, documentation, and a repayment plan are all important for securing the best loan options. Also, consulting a financial professional or consultant can be helpful. Unsecured loans can be risky – one wrong move and everything can crumble!

Unsecured Loans

Unsecured financing options don’t require collateral to secure funds. Still, they have higher interest rates due to the increased risk for the lender. Credit cards and lines of credit are examples of this type of loan. Business owners with limited assets find this appealing, as they can’t lose valuable assets if they default.

Secured options are less risky for borrowers, since their personal assets aren’t on the line. But, unsecured loans are more expensive due to high-interest rates. Lenders may need good credit scores or a substantial revenue history before approval.

Prolonged use of unsecured financing can lead to high debt and difficulty in meeting repayments due to compounding interest charges. Compare offers from different lenders before making a decision.

Pro Tip: Check out peer-to-peer lending platforms for competitive rates that don’t take as long as traditional banking institutions.

Line of Credit

A revolving loan offers a borrower the ability to withdraw funds up to a certain limit, without having to reapply each time. This is called a flexible line of credit.

It can be beneficial for short-term funding needs. Interest rates depend on the borrower’s creditworthiness and risk assessment. You can draw down and pay back multiple times, no extra application required. Plus, only interest is charged on the amount withdrawn. But, collateral or personal guarantee is necessary. Also, it could come with an annual fee or maintenance fee.

Businesses can use invoice financing, merchant cash advance, equipment financing, and microloans, based on eligibility and their needs. It’s important to assess the capacity to repay the loan and choose the right bad credit business loan. Negotiate with lenders for better terms and keep a watch on the credit score to increase future loan options.

Merchant cash advances are like payday loans for businesses, but the interest rates are so high, it’s like these loans are criminals!

Merchant Cash Advances

Cash Advances for Businesses are a type of bad credit business loan. They provide funds upfront, but the lender gets a percentage of future sales. We have created a table to show details such as: lender, loan amount, factor rate, and expected payment period.

| Lender | Loan Amount | Factor Rate | Expected Payment Period |

|---|---|---|---|

| ABC Bank | $10,000 | 1.2 | 3 months |

| XYZ Financial | $20,000 | 1.4 | 6 months |

It’s important to note that Cash Advances can have high-interest rates and lead to long-term financial problems. To avoid them, read and understand the terms and conditions before signing up. Ask financial experts for advice to identify risks and develop strategies.

Funding alternatives beyond Cash Advances exist. Get paid faster with invoice financing – a bad credit borrower’s dream!

Invoice Financing

Invoice factoring is a type of financing. It lets businesses obtain funding by selling their invoices to a financial institution. Here’s how it works:

| Upfront payment | Remaining Balance |

|---|---|

| The financial institution will give an upfront payment. This payment is usually based on the value of the invoices. It can be up to 80% of the total invoice amount. | After payments are collected, you’ll get the remaining balance minus a fee for their services. |

It’s not ideal for all types of business financing. Consider it in more detail before choosing it. Also, invoices that have been sold are usually not eligible as collateral for other types of credit or loans.

If you work with a reputable and trustworthy investor in micro-financing, it can help provide extra support and professional advice. Create strong cash flow management practices and billing procedures. This will help you plan for future financing needs proactively.

Qualifying for Bad Credit Business Loans

To qualify for bad credit business loans, you need to understand the factors that affect eligibility, as well as the specific documentation and requirements that lenders may require. Don’t worry if your credit score is low. You can still improve your chances of approval by following some essential tips. In this section, we’ll cover everything you need to know about qualifying for bad credit business loans with a focus on these three sub-sections.

Factors that Affect Eligibility

When lenders evaluate eligibility for a Bad Credit Business Loan, many criteria are taken into account. Factors such as Credit Score, Time in Business, Outstanding Debt, Annual Revenue, Cash Flow and Collateral have a big impact.

Also, the type of business, industry risk and personal financial history are all considered when a loan application is made.

Pro Tip: Improve your credit score and reduce debt to increase your chance of getting a Business Loan. Showing that you’re a responsible adult with paperwork could also help your credit score.

Documentation and Requirements

Submit Authenticated Records for a Comprehensive Loan Application.

To maximize your likelihood of being approved for bad credit business loans, it is essential to present precise and authenticated records that supplement your loan application. Have a look at the documentation and requirements in the table below for a more comprehensive loan application:

| Documentation and Requirements | Details |

|---|---|

| Business Plan | A full business plan to show potential success after loan is granted. |

| Financial Statements | Income Statements, Balance Sheets, and Cash Flow Statements to give lenders insight into your company’s finances. |

| Collateral | Offer assets with high equity as collateral. |

| Credit Score Report | Check credit history and correct any errors. |

Different lenders may also have other requirements in addition to those listed.

When reviewing applications, lenders may ask for specific documentation related to each requirement. Varying sources offer loans with different terms (loan amount, repayment schedule). Some need a minimum credit score and a lot of collateral, others just need a documented cash flow statement. Knowing these specifics will help you prepare a successful loan proposal.

When providing valid documentation and meeting basic requirements, the chances of obtaining bad credit business loans become higher. For example, Opportunity Fund gave “$10,000 loans that helped small business owners create or retain over 2,800 jobs” (Forbes). Increase your odds of getting approved by crossing your fingers, toes and all available appendages.

Tips to Improve Chances of Approval

Improving Chances of Approval for Business Loans with Poor Credit? It’s Possible! Got bad credit? Don’t worry, there are ways to up your chances of being approved.

- Set up a strong business plan to show the potential of your company.

- Create a budget and stick to it to demonstrate financial responsibility.

- Look for alternative lenders who specialize in bad credit ratings.

For extra assurance, have collateral like property or equipment to use as security. Pro Tip: Always be honest about your credit and finances when applying for business loans. This will help build trust and make approval more likely!

Finding the right bad credit loan? It’s like looking for a needle in a haystack – except the needle is interest rates and the haystack is rejection letters!

Choosing the Right Bad Credit Business Loan

To choose the right bad credit business loan with the right lender, analyzing the terms and conditions, and comparing rates and fees is the solution. These sub-sections will help you make an informed decision when selecting a lender and deal with bad credit.

Choosing the Right Lender

When searching for a Business loan provider with flawed credit, certain features should be considered. These include reputation, flexibility, and interest rates. Below is a table to help in the selection of the Right Lender:

| FEATURES | DESCRIPTION |

|---|---|

| Interest Rates | Generally higher due to added risk. |

| Collateral | Lenders that require collateral may offer lower interest rates with more reliance on assets. |

| Repayment Terms | Look for terms that provide flexibility while allowing to pay off the loan as soon as possible. |

| Processing Time | Some lenders may be quicker than others, but can charge costly fees. |

It is also important to find reviews or recommendations to understand the prospective lender’s service quality and experience.

Payment conditions should not be overlooked either. Some lenders may have no early repayment terms or impose hefty fines to cancel existing contracts. Banks may require collateral instead of favorable terms if you have no reliable income or acceptable income flow.

According to Forbes’ financial experts, technological advances such as AI allow online lending platforms to analyze millions of data points related to businesses and offer loans much faster than traditional banks. This can be a great relief, since reading those terms and conditions is like watching paint dry – except the paint is in Greek and you’re already asleep.

Analyzing the Terms and Conditions

It is essential to carefully analyze all terms and conditions of a bad credit business loan to understand its implications fully. Interest rates, fees, repayment schedules, and penalties for late payments should be considered when deciding which loan best suits one’s needs. The following table explains the different condition types and what they mean for potential financing.

| Condition Type | Description |

|---|---|

| Interest Rates | This is how much money is paid for borrowing. Compare interest rates from different lenders to get the most reasonable one. |

| Fees | Besides interest rates, lenders may charge registration, processing, or early repayment fees. Calculate the total amount you expect to pay back. |

| Repayment Schedules | Lenders may offer varied repayment plans. Choose one that fits your income flow and repayment ability. |

| Penalties for Late Payments | Clarify penalty policies before agreeing to a loan. |

Remember, each lender has its own terms and conditions. Read them carefully to find out if they meet your requirements. Furthermore, get info from previous borrowers or online reviews to avoid problematic creditors. Don’t let FOMO (Fear of Missing Out) lead to long-term consequences; research must be done before selecting a financial proposal. Finding the right bad credit business loan is like trying to find a needle in a haystack, but at least you know you’ll get pricked either way.

Comparing Rates and Fees

When assessing cost-effective bad credit business loans, understanding the nuances of comparing rates and fees is key. This helps make an informed decision based on the costs. Below is a table highlighting the different charges associated with availing bad credit business loans.

When comparing rates and fees, make sure to check for any hidden charges or penalties. Read the terms and conditions for complete clarity on repayment. Many lenders offer an online bad credit business loan calculator to calculate monthly payments based on interest rates, amount, and tenure. This feature allows quick comparison between loans and their costs.

In the past, businesses were subject to high interest rates. Today, many lenders have reduced interest rates and introduced new products. Sometimes the best alternative to a bad credit business loan is just a really good business plan and a bit of luck.

Alternatives to Bad Credit Business Loans

To explore alternatives to bad credit business loans with a focus on improving your financial standing, seeking assistance from the Small Business Administration, and looking for crowdfunding platforms. These sub-sections will offer different solutions for small businesses struggling to secure funding due to a poor credit score.

Improve Credit Score

Improving your Business’s Credit Score

Your business credit score affects lots of things! Struggling to get loans? Struggling to manage cash flow or invoices? Struggling with vendor relationships? Your credit score might be the problem. Here’s how to boost it:

- Make payments on time

- Lower your debt-to-income ratio

- Don’t open too many new accounts all at once

- Regularly check credit reports for errors

- Build a good payment history with Experian, Dun & Bradstreet, or Equifax

To get a better rating from creditors and lenders, you need to create a good payment history. Reduce utilization rates and don’t max out credit lines. Communicate with vendors.

Another option is to find guarantors to back up borrowing activities. A company once had trouble because of bankruptcy, but got help from investors who offered extended repayment periods and lower interests. The Small Business Administration can help too. It’s like having a personal financial advisor without the awkward brunch dates.

Seek Assistance from Small Business Administration

The Small Business Administration (SBA) offers entrepreneurs a way to avoid bad credit business loans. Programs provide financial assistance, counseling, and training services. Plus, they work with lenders to guarantee loans so those with low credit scores can get funds without unfavorable loan terms.

Through the SBA, entrepreneurs have access to guidance and funding opportunities. For example, the 7(a) Loan Program provides small businesses with long-term financing at competitive rates. The SBA also helps with disaster recovery and export initiatives.

The SBA operates district offices across the country. Through these, entrepreneurs can get personalized consultations and resources to help them grow and succeed.

Forbes magazine reports businesses that receive SBA support are more likely to stay in operation than those that don’t. So, forget bad credit loans and look to crowdfunding for success! A supportive community of investors awaits.

Look for Crowdfunding Platforms

No Credit? No Problem! Crowdfunding is the Smart Alternative to Bad Credit Loans.

Crowdfunding has become a great choice for startups and small businesses that have bad credit or none at all. This new way of raising money has changed the traditional lending world, making it easier for entrepreneurs to make their visions come alive.

Here are six ways crowdfunding can help you and your business:

- 1. No credit checks mean even more opportunities.

- Increase your exposure and build your brand

- Receive feedback from potential clients by using pre-sales campaigns.

- Test your concept with minimum investment and risk.

- Take advantage of a supportive community of like-minded people.

- Have flexible funding options tailored to your needs.

Crowdfunding offers distinct advantages that other lenders don’t, making it a great option.

So, if you’re looking for a way to raise capital without giving up equity or collateral and get better loan conditions than traditional banks, then crowdfunding is the perfect solution.

Don’t miss out on the chance to fund your idea using crowdfunding platforms. Sign up now! Don’t let bad credit be the end of your business. Explore these options and find the right answer to write a successful ending.

Conclusion: Finding the Right Solution for Your Business

As a business owner, locating the right funding for your business can be tricky. Remember to look at aspects such as interest rates, repayment terms, and approval requirements to get the best solution for your business.

Keep in mind that bad credit business loans may seem like a great source of finance if you have less-than-perfect credit scores. However, evaluate whether it suits your business’s needs before you go ahead with this option.

Exploring different lenders and understanding their lending policies can help you select a suitable solution. This way, you can match offers from different lenders and pick the one which suits your unique business needs.

When deciding on loan options, it is wise to look into alternatives such as government-assisted plans or financing services offered by non-bank institutions. The benefit of these services is their flexibility and simpler application processes compared to traditional forms of financing.